Written for financial planners, great advice for you

10 best pieces of tax advice from financial planners

Was written by Michael Lewis for life and health insurance advisors. However, it contains great advice for everyone.

Here are key tips about tax planning:

- Always file a tax return.

- Remember that tax planning is a year-round exercise.

- Keep good records

- Report all income

- Transfer income to a non-taxable status

- Maximize personal deductions

- Maximize business expenses

- Utilize tax-advantaged retirement accounts to the max

- Establish a coverdell ESA or a state 529 plan for college expense

- Use available tax credits

- Defer and accelerate income and expenses to your advantage

Finally, the article suggests our favorite (and completely self-serving) strategy: “If your clients' incomes are high, their investments constantly changing, they own a business, or intend to do any estate planning, the services of a competent tax professional are invaluable.”

To read the entire article, click here.

Excellent, free financial calculators

An advertising-supported financial comparison site, offers dozens of free financial calculators within each of a dozen different financial categories. For example, under the “Retirement” heading, you’ll find 39 different calculators!

Here are the general subjects about which you can find wonderful tools to help you plan every aspect of your financial life:

- Mortgage

- Home Equity

- CDs & Investments

- Checking & Savings

- Auto

- Credit Cards

- Debt management

- Insurance

- Retirement

- Taxes

- Personal Finance

- Small Business

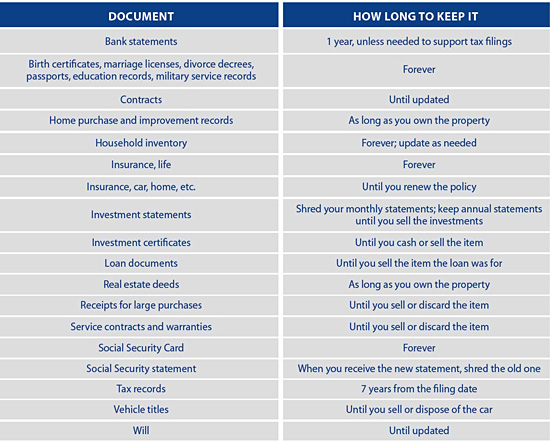

How long should I keep personal financial records?

How long should I keep business records?

The IRS provides a wealth of information on recordkeeping. However, we like this handy list, available at Rocketlawyer.com, a service that offers many free legal documents, plus access to affordable legal counsel via various paid membership levels.

Some business records should be kept permanently:

- Audit reports and charts of accounts

- Canceled checks for important payments

- Records of capital stocks and bonds

- Contracts and leases still in effect

- Legal correspondence

- Deeds, mortgages, bills of sale

- End of year financial statements

- Insurance records

- Minutes, bylaws, and charters

- Property appraisals and records

- State and federal income tax returns

- Trademark registrations

Other records are commonly kept for less time. However, we often advise clients to be conservative, and keep the following records for seven years:

- Accident reports and claims

- Ledgers and schedules for accounts payable and receivable

- Bank statements

- Cash books

- Most canceled checks

- Expired contracts and leases

- Product, material and supply inventory

- Customer and vendor invoices

- Ledger and schedules for notes receivable

- Option records

- Payroll account records

- Purchase orders

- Sales records

- Canceled stock and bond certificates

- Vouchers

Source: www.rocketlawyer.com/article/how-long-to-keep-records-for-business-taxes.rl. For more information about business taxes, go to www.irs.gov

Which documents should I store away from my home?

Consider keeping copies of the following documents in a safe deposit box or locked in a fireproof/waterproof safe in your home:

- Adoption papers

- Advance directives*

- Birth and death certificates

- Citizenship papers

- Contracts of importance

- Deeds and property titles

- Household inventory

- Life insurance policies

- Marriage licenses and divorce decrees

- Military discharge papers

- Passports

- Powers of attorney*

- Social Security cards

- Stock and bond certificates

- Wills*

*Since the safe deposit box will be sealed at your death, keep a copy of your will somewhere accessible. The same goes for the advance directive and powers of attorney since you may not be able to give others access to the safe deposit box.

Source: www.usa.gov/Topics/Money/Personal-Finance/Managing-Household-Records.shtml

Make a household inventory

Several years ago, the U.S. General Services Administration, Insurance Information Institute, put together a useful, printable guide to preparing a household inventory.

An inventory of items in your home will help you buy the right amount of insurance coverage. It also will help you speed up any claims you may need to file. And if necessary, can help you document losses to declare on your income tax return.

Many of us in New York and New Jersey felt the wrath of Superstorm Sandy. The devastation of Superstorm Sandy should serve as a reminder to keep records of what you own, and to protect your important documents.

Get the simple, free household inventory guide here.

A helpful warning

If the IRS ultimately determines that you still owe money that you haven’t paid, you may be surprised to learn that there are four different ways the IRS can collect from you:

1. Wage levy—up to 85% of your gross wages

2. Bank levy—the IRS can take all of your funds

3. Tax lien—the kiss of death to your credit score

4. Asset seizure—nothing you own is safe

Emergency financial preparedness

When we think of emergency planning, most people think of food, water, flashlights, fresh batteries, medications, and blankets.

However, a fire or flood also can wreak havoc on your financial well-being.

Here’s a helpful—and free—guide to what you should store and how to keep your important documents safe. See FEMA document #532, the Emergency Financial First Aid Kit

Source: www.operationhope.org/images/uploads/Files/effak2.pdf